|

Getting your Trinity Audio player ready...

|

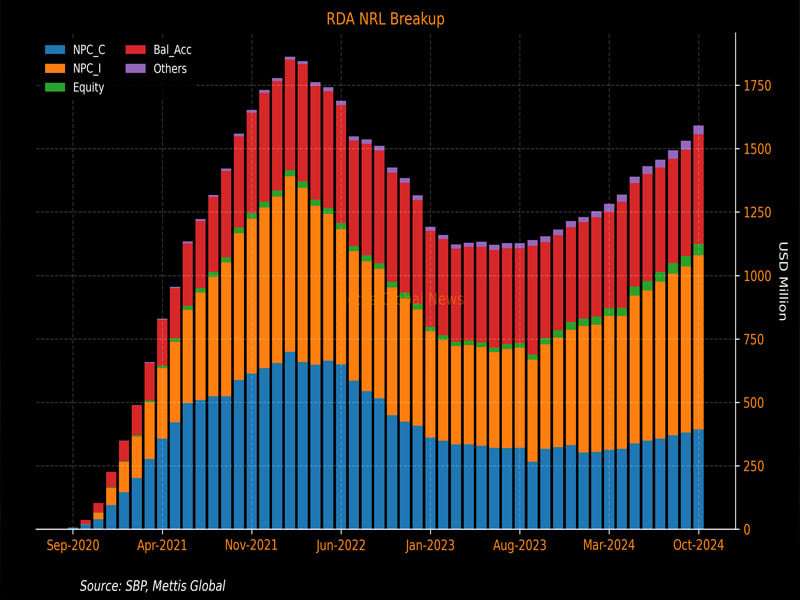

KARACHI: In October 2024, overseas Pakistanis significantly boosted their deposits and investments through the Roshan Digital Account (RDA), amounting to $204 million. This substantial inflow has pushed the cumulative gross inflows close to $9 billion over 50 months since the RDA’s launch in September 2020. This notable increase, as per data released by the State Bank of Pakistan (SBP) on Monday, highlights the critical role of RDA in strengthening Pakistan’s foreign exchange reserves.

Current Status of RDA Inflows

Topline Research reported that the recent inflows were significantly higher than the last six-month average of $187 million and the overall average of $179 million since the RDA’s inception. Net inflows, which are gross inflows minus funds used and withdrawn, stood at $193 million in October, surpassing the six-month average of $173 million and the average of $146 million since the scheme began.

Arif Habib Limited noted that since its inception, net deposits and investments by non-resident Pakistanis through RDA reached $1.59 billion against gross inflows of $8.95 billion. Overseas Pakistanis withdrew $1.67 billion and spent $5.69 billion in Pakistan.

Breakdown of Investments

- Naya Pakistan Certificates (NPCs): $393 million

- Shariah-compliant NPCs: $687 million

- Roshan Equity Investment (REI) at PSX: $45 million

- RDA Account Balances: $431 million

Foreign Direct Investment (FDI) Trends

In contrast, Pakistan saw a decline in net foreign direct investment (FDI) across sectors like energy, banking, and telecommunications, hitting a 15-month low of $133 million in October 2024. A senior analyst mentioned that higher inflows were expected, but a foreign holding company sold equity worth $150 million due to changes in global indices by FTSE.

FDI Overview

Despite the dip in October, cumulative FDI inflows for the first four months of the current fiscal year rose by 32% to $904 million compared to $684 million in the same period last year. However, October’s FDI was 18% lower than the $163 million recorded in the same month last year and 65% lower than the $385 million in September 2024.

Sector-Wise FDI Inflows (First Four Months)

- Power Sector: $414 million

- Financial Businesses: $190 million

- Oil and Gas Exploration: $104 million

- Electronics: $54 million

Country-Wise FDI Inflows (First Four Months)

- China: $414 million

- Hong Kong: $100 million

- United Kingdom: $94 million

- Switzerland: $51 million

Real Effective Exchange Rate (REER) Appreciation

Pakistan’s real effective exchange rate (REER), representing the domestic currency value against a basket of trading partners’ currencies, appreciated to 100.86 in October 2024 from 98.64 in September. This appreciation suggests a strengthening of the local currency, though it remains near its fair value of 100. The improvement primarily resulted from lower global and local inflation readings, with the rupee-dollar exchange rate stable at Rs277-278/$ during September-October 2024.

Impact of REER on Economy

The appreciated REER has reduced import costs, supporting an increase in imported goods and services. However, it has made exports slightly more expensive, potentially impacting Pakistan’s competitiveness in global markets. Alpha Beta Core CEO Khurram Schehzad emphasized that maintaining the REER index at around 100 is crucial for competitive exports and controlled imports, which are vital for managing trade and current account deficits.

Monetary and Fiscal Recommendations

Schehzad recommended keeping the REER index at or below 95 to enhance export competitiveness and control imports. Additionally, he urged monetary authorities to combat smuggling and maintain low import tariffs to discourage illegal trade and ensure local market competitiveness. Despite these measures, the Pakistani rupee saw a slight depreciation of Rs0.19 against the US dollar in the inter-bank market on Monday, following a brief uptrend.

FAQs

1. What is the Roshan Digital Account (RDA)?

Answer: The Roshan Digital Account (RDA) is an initiative by the State Bank of Pakistan allowing non-resident Pakistanis to open and operate digital accounts in Pakistan, facilitating investments and transactions in the country.

2. How has the RDA impacted Pakistan’s foreign exchange reserves?

Answer: RDA inflows have significantly bolstered Pakistan’s foreign exchange reserves, improving the country’s import cover to two months and stabilizing the economic outlook.

3. What are Naya Pakistan Certificates (NPCs)?

Answer: NPCs are investment certificates offered to overseas Pakistanis through RDA, available in both conventional and Shariah-compliant formats, providing attractive returns on investment.

4. Why did Pakistan see a decline in FDI in October 2024?

Answer: The decline was partly due to a foreign holding company selling $150 million worth of equity following changes in global indices by FTSE, impacting overall FDI figures.

5. What is the Real Effective Exchange Rate (REER)?

Answer: REER is an index measuring the value of a country’s currency against a basket of currencies from its trading partners, adjusted for inflation differentials. It indicates the competitiveness of the country’s goods and services in the international market.

MUST READ:

https://skipper.pk/2024/11/19/current-account-surplus-hits-349-million/